Case Study: Baytex and Peavine Métis Partnership and Financial Analysis

- IEM

- Jun 23

- 9 min read

Updated: Jul 12

Indigenous-Industry Partnerships in Canada

Across Canada, partnerships between Indigenous communities and resource companies are increasingly recognized as a cornerstone of responsible economic development. As Indigenous nations assert greater sovereignty over their lands and resources, collaboration with industry is emerging as a powerful mechanism to align economic opportunity with Indigenous rights and long-term stewardship. These agreements often involve complex arrangements, ranging from equity ownership and royalty structures to employment commitments and land access terms. When structured fairly, such partnerships can generate long-term revenue, enhance local capacity, and ensure Indigenous communities have a meaningful voice in shaping development on their territories.

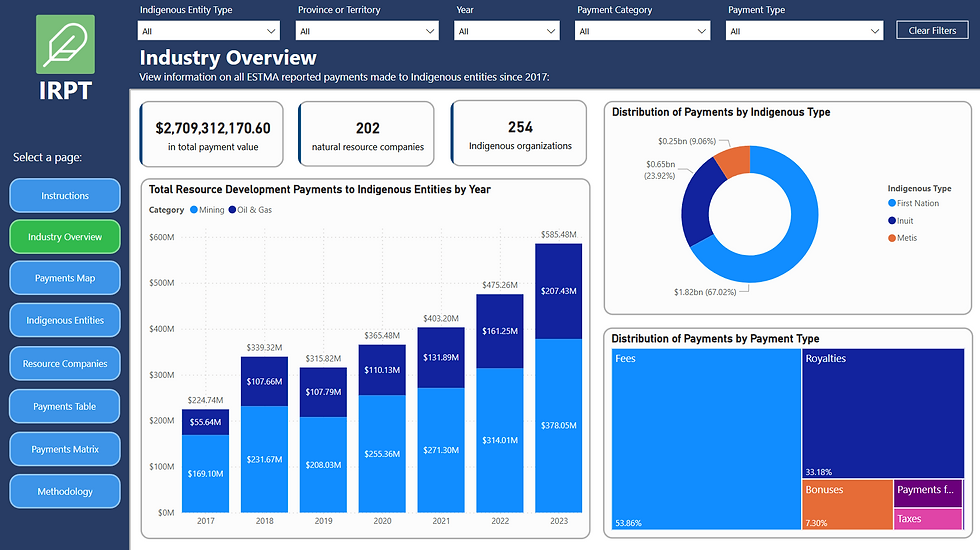

At Indigenous Energy Monitor (IEM), we are tracking over $3.2 billion in payments made by Canada’s largest resource companies to Indigenous governments and communities in connection with resource development projects. This data, captured through our Indigenous Resource Payment Tracker (IRPT), offers unprecedented visibility into the financial scope and structure of Indigenous-industry partnerships nationwide.

This case study explores the growing partnership between Baytex Energy Corporation and the Peavine Métis Settlement in Alberta. By combining publicly available oil production and financial data with payment data from the IRPT, we provide a clearer picture of the financial outcomes of the partnership. Our analysis sheds light on deal structures and enables royalty rate estimates, demonstrating how data transparency can uncover the true economic value of Indigenous-industry partnerships and offer actionable insights for Indigenous communities, resource developers, and other industry proponents.

Background

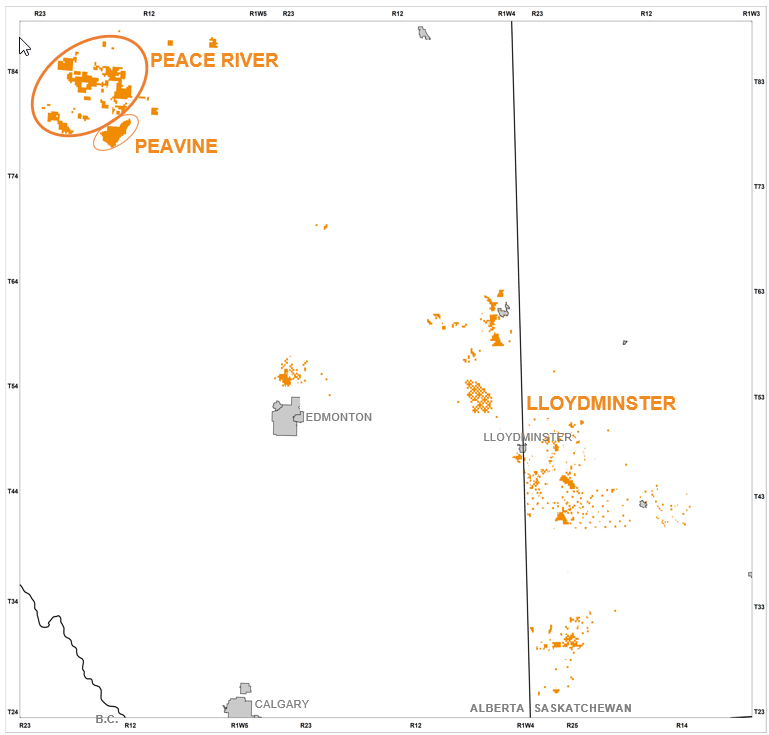

Baytex Energy Corporation (Baytex) is a mid-sized energy company headquartered in Calgary, Alberta, with operations in the Western Canadian Sedimentary Basin and the Eagle Ford in Texas. The company focuses on the acquisition, development, and production of crude oil and natural gas, producing approximately 153,048 boe/d in 2024 (Baytex 2024).

Peavine Métis Settlement (Peavine) is one of eight Métis settlements in Alberta, spanning approximately 82,364 hectares of collectively managed land. Located in Big Lakes County, about 56 km north of High Prairie, Peavine is home to an estimated 300-400 people. The community is governed by the Peavine Métis Council, an elected body under Alberta’s Métis Settlements Act.

Peavine is located on the Clearwater play, one of Alberta’s most active and economically significant oil plays in recent years. The Clearwater formation is known for its shallow, heavy oil reservoirs. Baytex has focused much of its recent development efforts in this area, where it produces primarily from heavy oil wells with strong economics and repeatable drilling results. Peavine’s lands host valuable heavy oil reserves that are a part of this Clearwater trend, making the settlement a strategically important partner for companies seeking long-term development opportunities in this rich area.

In January 2020, Peavine and Baytex signed an Economic Development Agreement, which was negotiated and approved by the Peavine Council. This agreement marked the formal consent of the community to exploration and development activities on their land and signaled a proactive, partnership-based approach to managing the resource opportunity.

Baytex’s heavy oil expertise and its strategic expansion into the Peace River and Clearwater region aligned well with Peavine’s goal of leveraging its natural resource assets for long-term community benefit. The result is a compelling example of Indigenous-industry partnership grounded in mutual interest, shared value, and equitable participation.

Partnership Timeline

2020: Baytex and Peavine sign an Economic Development Agreement covering 60 sections of land for the exploration and development of heavy oil resources (Baytex, 2022).

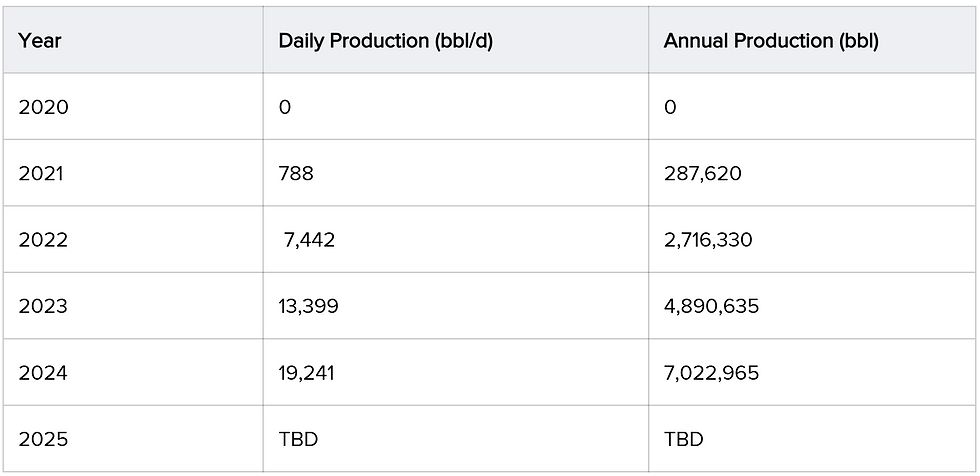

2021: Initial exploratory drilling begins. Peavine oil production ramps to about an average of 788 bbl/d. A second agreement between the partners expands the development area to 80 sections (GlobeNewswire, 2022).

2022: Full-scale production begins. 23 new wells brought online. Average production reaches 7,442 bbl/d. Baytex invest $50 million on exploration and development of Peavine acreage (Baytex, 2023).

2023: Peavine production averages 13,399 bbl/d. Baytex drills 31 Clearwater wells. Agreement for 10 additional sections of land (Baytex, 2024).

2024: Production hits highest level yet at an average of 19,241 bbl/d. 31 wells brought online. Partnership matures into steady-state development (Baytex, 2025).

2025: Baytex expect to bring 33 net MLHZ wells onstream in 2025 (Baytex, 2025).

This timeline highlights the incredible growth and economics of Baytex’s Clearwater operations on Peavine lands. Oil production went from zero in 2020 to a major oil project by 2023. By securing land rights and working closely with the Métis Settlement, Baytex unlocked a prolific heavy oil reservoir that quickly became one of its top assets. Peavine, in turn, evolved into an influential resource developer, capturing significant royalties and other payments as outlined in the coming sections of this case study.

Production Overview

The following table outlines the reported average production rates of Baytex's wells on Peavine lands covered under the Economic Development Agreement.

Figure 1: Production Rates of Baytex Wells on Peavine Lands

Resource Payments

According to our IRPT data, Baytex has paid Peavine $44,240,000 CAD in total compensation for the development and extraction of heavy oil since the signing of the Economic Development Agreement in 2020 to 2024, the most recent year with full data.

Figure 2: Payments to Peavine by Type

Figure 3: Table of Payments to Peavine (CAD)

Approximately 78% of the reported payments made to Peavine by Baytex are in the form of royalties, reflecting the central role of resource revenue sharing in the partnership. In addition to royalties, bonuses were paid out each year, beginning with an initial $1.83 million signing bonus in 2020, the year the Economic Development Agreement was executed.

The largest bonus payment, $2.84 million, was made in 2023, which was the year with the most significant year-over-year increase in heavy oil production on Peavine lands, suggesting a link between production growth and bonus structures.

From 2020 to 2024, fees totaled $1.79 million, likely related to land access, lease agreements, and other development-related charges.

Notably, tax payments to Peavine started to be reported in 2023, and infrastructure-related payments were recorded in 2021, highlighting the evolving nature of the agreement and expanding areas of benefit for the community.

Royalty Analysis

By combining Baytex’s publicly reported heavy oil production volumes and realized oil sales prices with the royalty payments disclosed as part of its agreement with Peavine, we can estimate an inferred royalty rate as a percentage of realized sales revenue (total sales, net of blending and other expenses) and on a per-barrel basis.

Inferred Royalty Rate = (Reported Royalties) / (Realized Sales Revenue)

Inferred Royalty Per Barell = (Reported Royalties) / (Annual Production)

This analysis provides a window into the underlying financial terms of the 2020 Economic Development Agreement and offers valuable insight into the economic impacts of resource development on Indigenous communities, as well as how oil resources are being valued on Indigenous lands.

We will calculate the inferred royalty rates from 2021 when oil production started to 2024, the year with the most recent available data.

Figure 4: Baytex - Peavine Royalty Analysis (CAD)

Analysis Results

Using Baytex’s publicly disclosed production and sales data, we estimated annual realized sales revenue and calculated an inferred royalty rate for each year. Key findings include:

Inferred royalty rates ranged from 2.86% to 4.15%, averaging approximately 3.4% of realized sales revenue over the four-year period.

Despite market volatility, royalty revenues per barrel remained relatively stable, fluctuating only between $2.19 and $2.47 and averaging $2.37 per barrel.

To contextualize these inferred rates, we compared them against a known royalty benchmark:

In Baytex’s 2024 Annual Report, the average royalty paid across all operations in Canada was 16.2% of realized sales revenue, or $11.16 per barrel of oil equivalent (Baytex, 2024). This rate is inclusive of all royalties paid to the Crown, private landowners, and Indigenous communities.

Figure 5: Peavine Royalty Rate Benchmarked ($/bbl)

At first glance, the royalty rate received by Peavine appears modest in comparison to Baytex's average royalty for its Canadian operations. However, it is critical to consider the unique legal, regulatory, and historical context of resource development on Métis Settlement lands. These lands are governed under a distinct framework that determines royalty rate structures for oil & gas developments and who actually owns the mineral resources under the surface.

Resources on Métis Settlement Lands

Métis Settlements in Alberta (eight in total) have a unique co-management arrangement with the province for subsurface resources. The Province of Alberta technically owns the minerals under Métis Settlement lands, but since 1990 the Co-Management Agreement (CMA) has empowered Settlements to benefit from resource development. Under the CMA, when Alberta issues an oil and gas lease on Settlement lands, the Métis Settlement can negotiate an additional royalty (an “overriding royalty”) on top of the provincial Crown royalty (Wayne N Renke, 2014). In other words, the developer pays the normal Alberta royalty to the province and an extra royalty to the Settlement’s governing body. The CMA also allows the Settlement to negotiate up to a 25% equity participation (Metis Settlements General Council, 2025), though royalties (being risk-free) are often favored by the community. Settlements can also directly bid or buy Crown leases on their lands via a Settlement-owned corporation

In practice, companies seeking leases on Métis Settlement lands must include in their bid a Métis benefits proposal, which typically addresses hiring, environmental protection, and the overriding royalty and/or equity to be provided (Wayne N Renke, 2014). The Métis Settlements General Council (MSGC) has a policy on resource revenue-sharing: a base overriding royalty up to 3% (of production value) goes into a general fund for all Settlements, while any royalty above 3% is retained by the specific Settlement where the production occurs (Wayne N Renke, 2014).

As our analysis revealed, Baytex’s operations on Peavine lands in the Clearwater heavy oil play generates an average overriding royalty of 3.4% of realized production sales revenue or about $2.37 per barrel.

It’s important to note that as per the CMA, the Peavine royalty is in addition to Alberta’s Crown royalty. The Crown generally collects 5% to 40% depending on various project factors and oil prices. Thus, the total royalty burden on Peavine lands that Baytex must pay would be much greater than just the rate we calculated for Peavine. This helps to explain why Baytex reported an average royalty rate of 16.2% or $11.16 per barrel in 2024, as this is inclusive of higher Crown and private land royalties.

While Peavine’s royalty rate is lower than typical Crown land or private land benchmarks, it reflects the unique benefit-sharing model on Métis Settlement lands, where communities receive a portion of revenues despite not owning full mineral rights.

Conclusion

In the coming years, we expect oil production to grow on Peavine lands as Baytex continues to develop the resources and invest in the area that has a proven track record of high-performing assets. As such, we expect to see increasignly more compensation paid out to Peavine, including an increase in royalties and likely other payment types such as bonuses for production milestones and additional fees for land access considerations.

The Baytex-Peavine partnership is a clear example of how Indigenous communities can directly benefit from resource extraction on their lands and the unique considerations involved in these partnerships. Our analysis shows a mutually beneficial growth story, and the financial data confirms substantial value flowing to the community.

Thanks to transparency initiatives such as the IRPT, anyone can monitor and analyze these outcomes. As Indigenous nations push for greater ownership and control over resources, having tools to track payments is crucial for informed decision-making. The Peavine case demonstrates that when provided with clear data, Indigenous communities can quantitatively evaluate the success of their partnerships, strengthening their position in Canada’s energy sector.

Data Limitations

The Indigenous Resource Payment Tracker relies on publicly available data disclosed under the Extractive Sector Transparency Measures Act (ESTMA). This legislation requires certain resource companies to report payments made to governments related to the commercial development of oil, gas, and minerals. While this data provides valuable insight, it has notable limitations:

Reporting Threshold: Payments totaling less than $100,000 within a calendar year are not required to be disclosed.

Rounding: Reported figures are often rounded to the nearest $10,000, reducing precision.

Disclaimer: This analysis is based on publicly disclosed data and is intended for informational purposes only. It represents an informed estimate and should not be interpreted as a precise account of actual deal terms. It does not constitute financial, legal, or investment advice.

Unlock Transparency for Resource Development

This case study underlines the importance of transparency tools like the Indigenous Resource Payment Tracker for Indigenous communities and companies engaged in resource development. By aggregating company-reported payment data pursuant to Canada's Extractive Sector Transparency Measures Act in one place, the IRPT enables users to track the monetary flows from projects on Indigenous lands.

In this analysis, we demonstrated how one can calculate inferred royalty rates and get insight into financial details of otherwise confidential and little-known agreements.

By centralizing and visualizing payment data, we help communities, companies, and policymakers:

Identify which Indigenous communties are being paid and for why

Discover payment flows, types, amounts, and details

Benchmark successful agreement models

Understand trends across regions and sectors

Discover partnerships

And so much more

🔗Discover the IRPT Tool Here: https://www.indigenousenergymonitor.ca/irpt

Stay Informed, Get Involved

Whether you're an Indigenous economic development organization evaluating new opportunities or a resource company seeking data-driven insights to inform decision-making, Indigenous Energy Monitor offers essential tools and analysis to support your success.

🔗 Explore our solutions: www.indigenousenergymonitor.ca

📩 Contact us: info@indigenousenergymonitor.ca

Comments