Case Study: Champion Iron and Innu Takuaikan Uashat Mak Mani-Utenam Partnership and Financial Analysis

- IEM

- Aug 18, 2025

- 7 min read

Updated: Nov 13, 2025

Indigenous-Industry Partnerships in Canada

Across Canada, natural resource development is inseparable from Indigenous rights and participation. Companies must meaningfully consult with, and where appropriate, accommodate Indigenous communities whose rights and interests may be affected by a project. In many cases, these discussions lead to formal agreements — often Impact Benefit Agreements or similar arrangements — that outline how a resource project will deliver meaningful benefits to impacted communities. These commitments can include environmental protections, cultural and traditional safeguards, skills training, employment opportunities, community investments, and broader socio-economic measures. Agreements like these help form strategic partnerships that position Indigenous-communities as critical decision-makers and economic stakeholders in Canada's energy and resource sectors.

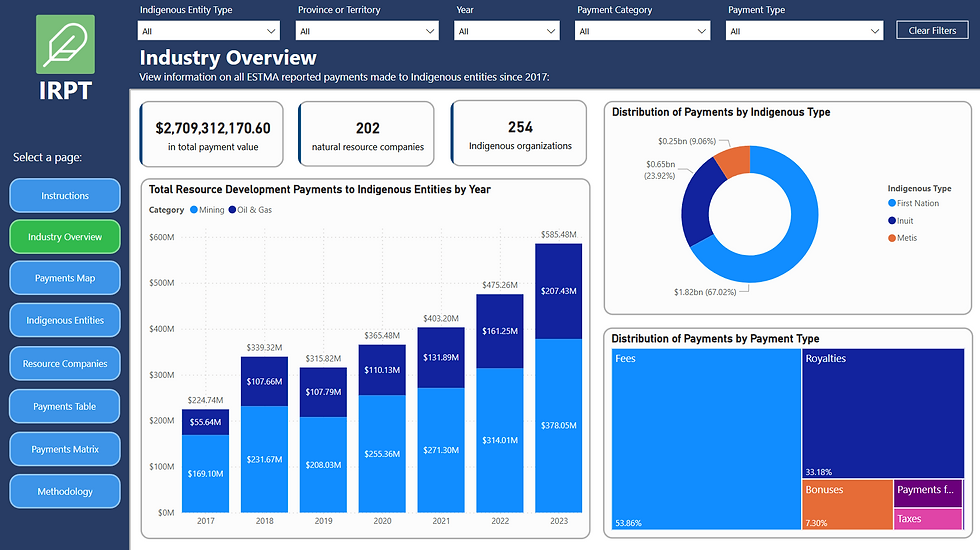

At Indigenous Energy Monitor (IEM), we are tracking over $3.3 billion in payments made by Canada’s largest resource companies to Indigenous governments and communities in connection with resource development projects. This data, captured through our Indigenous Resource Payment Tracker (IRPT), offers unprecedented visibility into the financial scope and structure of Indigenous-industry partnerships nationwide.

This case study explores the growing partnership between Champion Iron Limited and the Innu Takuaikan Uashat Mak Mani-Utenam in Quebec for the Bloom Lake Iron Mine. By combining publicly available iron production and financial data with payment data from the IRPT, we provide a clearer picture of the financial outcomes of this partnership. Our analysis sheds light on deal structures and enables royalty rate estimates, demonstrating how data transparency can uncover the true economic value of Indigenous-industry partnerships.

Background

Champion Iron Limited (Champion Iron) is an iron development and exploration company, focused on developing its significant iron resources in the south end of the Labrador Trough in the province of Québec. Following the acquisition of its flagship asset, the Bloom Lake Iron Mine in 2016, the company’s main focus is to implement upgrades to the mine and processing infrastructure it now owns while also advancing projects associated with improving access to global iron markets.

The Innu Takuaikan Uashat Mak Mani-Utenam (ITUMMU) is the band government representing the Innu of Uashat Mak Mani-Utenam, a distinct Indigenous community within the Great Innu Nation. Based in Sept-Îles, Quebec, ITUMMU governs two reserves—Uashat 27 and Maliotenam 27A—situated on either end of the city, and is a member of the Mamuitun Tribal Council. The community’s traditional territory, known as Nitassinan, covers a vast area of the Quebec–Labrador Peninsula north of the 49th parallel. For the Innu, Nitassinan is the foundation of their identity, culture, language, and way of life, containing hunting grounds, portage routes, birthplaces, burial sites, and generations of history. ITUMMU asserts Aboriginal title and other rights over this territory.

Champion Iron's Bloom Lake Mine is located within the Nitassinan traditional territory. As such, Champion Iron has a duty to consult with ITUMMU for the development and extraction of natural resources.

On April 12, 2017, Champion Iron, and the band council of ITUMMU entered into an Impact Benefit Agreement (IBA) with respect to operations at the Bloom Lake Mine. The IBA is a life-of-mine agreement and provides for real participation in Bloom Lake for the people of ITUMMU in the form of training, jobs and contract opportunities, and ensures that the the First Nation will receive fair and equitable financial and socio-economic benefits. The IBA also contains provisions which recognize and support the culture, traditions and values of the ITUMMU, including recognition of their bond with the natural environment.

Partnership Timeline

2005-2010: Consolidated Thompson Iron Mines developed Bloom Lake and started production in 2010 (Consolidated Thompson Iron Mines Limited, 2011).

2011: Cliffs Natural Resources acquired Consolidated Thompson with Bloom Lake as the key asset (Cliffs, 2011).

2014: Cliffs idled Bloom Lake, amid a sharp iron-ore price downturn and strategic retrenchment from Eastern Canada (Cliffs, 2014).

2015: Cliffs’ Bloom Lake entities entered CCAA creditor protection in early 2015, with a court-supervised Sale and Investor Solicitation Process. Champion Iron agreed to buy Bloom Lake + rail assets + claims for C$10.5M cash, assuming about C$42M–C$43M in environmental and other liabilities (Champion Iron, 2015).

2016: Quebec courts approve the sale and Champion Iron closes its acquisition of the Bloom Lake Mine (MFQ, 2016).

2017: Champion Iron and ITUMMU enter into an IBA for the life of the Bloom Lake Mine (Champion Iron, 2017).

2018: Iron production begins at the mine (Champion Iron, 2019).

2020: Champion Iron’s Board gave approval for Phase II expansion of the mine (Champion Iron, 2020).

2022: Phase II officially reached commercial production, doubling output capacity to approximately 15 Mtpa (Champion Iron, 2025).

Bloom Lake Mine Overview

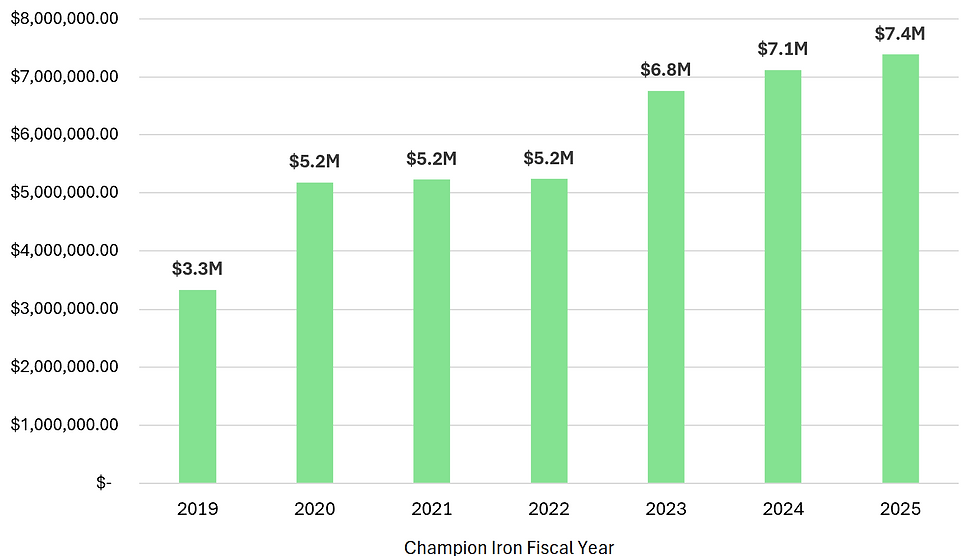

The Bloom Lake Mine produces iron ore concentrate which is a processed form of iron ore, refined to have high iron content and low levels of impurities. The following table outlines the reported annual iron ore concentrate sales from Bloom Lake Mine since operations began in Champion Iron's 2019 Fiscal Year. The sales volumes are reported in dry metric tonnes (dmt).

Figure 1: Iron Sales from Bloom Lake Mine

Resource Payments

According to our IRPT data, Champion Iron has paid ITUMMU $40,252,000.00 CAD in total compensation for the development and extraction of iron ore concentrate since mine operations began in FY2019 up to FY2025 ending March 31, 2025. These payments were all reported to be royalties and are in Canadian dollars.

Figure 2: Reported Royalty Payments Made to ITUMMU

All reported payments from Champion Iron to ITUMMU are royalties, underscoring the importance of resource revenue sharing in their partnership. In FY2025, royalties reached a record $7.4 million—the highest since Bloom Lake began operations. The sharp increase from FY2022 to FY2023 aligns with the December 2022 completion of the phase II expansion, which boosted iron ore production and subsequent royalty revenues.

Royalty Analysis

By combining Champion Iron's publicly reported sales volumes and net average realized sales prices with the reported royalty payments, we can estimate an inferred royalty rate as a percentage of realized sales revenue (total sales, net of shipping and other costs) and on a per-dry metric tonne (dmt) of iron concentrate basis.

Inferred Royalty Rate = (Reported Royalties) / (Realized Sales Revenue)

Inferred Royalty per Dry Metric Tonne of Iron Concentrate = (Reported Royalties) / (Annual Sales Volume)

This analysis provides a window into the underlying financial terms of the 2017 IBA and offers valuable insight into the economic impacts of resource development on Indigenous communities, as well as how iron resources are being valued on traditional Indigenous territory.

We will calculate the inferred royalty rates from FY2019 when iron production started to FY2025, the year with the most recent available data. Analysis is all in Canadian dollars.

Figure 4: Royalty Rate Analysis

Analysis Results

Our analysis indicates that inferred royalty rates paid by Champion Iron to ITUMMU ranged from 0.41% to 0.66% of net sales revenue, averaging 0.48% over the seven-year period. On a per-tonne basis, rates ranged between $0.47/dmt and $0.68/dmt, with a seven-year average of $0.62/dmt.

Year-to-year fluctuations in the inferred rates are driven primarily by changes in iron ore prices, sales volumes, production costs, and potentially the structure of the underlying royalty agreement. Higher market prices or production levels generally increase total royalty payments, while lower prices or volumes reduce them. Since the exact contractual terms are not public, these inferred rates are an informed estimate that reflect market and operational variability rather than a fixed contractual percentage.

Conclusion

In the coming years, we expect iron production to grow at Bloom Lake Mine as Champion Iron continues to develop the resources and invest in the area that has a proven track record of high-performing assets. As such, we expect to see increasingly more compensation paid out to ITUMMU through royalty payments.

The Champion Iron - ITUMMU partnership is a clear example of companies and Indigenous communities can directly benefit from resource development through collaboration and respect. Our analysis shows a mutually beneficial growth story, and the financial data confirms substantial value flowing to the community. It is also important to recognize that there are more than just financial benefits for the community as a result of the partnership and IBA. These include employment, training, cultural, and environmental commitments as well.

By using transparency tools like the IRPT, we were able to calculated an inferred royalty rate and gained deeper insight into the financial structures behind IBAs.

Data Limitations

The Indigenous Resource Payment Tracker relies on publicly available data disclosed under the Extractive Sector Transparency Measures Act (ESTMA). This legislation requires certain resource companies to report payments made to governments related to the commercial development of oil, gas, and minerals. While this data provides valuable insight, it has notable limitations:

Reporting Threshold: Payments totaling less than $100,000 within a calendar year are not required to be disclosed.

Rounding: Reported figures are often rounded to the nearest $10,000, reducing precision.

Disclaimer: This analysis is based on publicly disclosed data and is intended for informational purposes only. It represents an informed estimate and should not be interpreted as a precise account of actual deal terms. It does not constitute financial, legal, or investment advice.

Unlock Transparency for Resource Development

This case study underlines the importance of transparency tools like the Indigenous Resource Payment Tracker for Indigenous communities and companies engaged in resource development. By aggregating company-reported payment data pursuant to Canada's Extractive Sector Transparency Measures Act in one place, the IRPT enables users to track the monetary flows from projects on Indigenous lands.

In this analysis, we demonstrated how one can calculate inferred royalty rates and get insight into financial details of otherwise confidential and little-known agreements.

By centralizing and visualizing payment data, we help communities, companies, and policymakers:

Identify which Indigenous communties are being paid and why

Discover payment flows, types, amounts, and details

Benchmark successful agreement models

Understand trends across regions and sectors

Discover partnerships

And so much more

🔗Discover the IRPT Tool Here: https://www.indigenousenergymonitor.ca/irpt

Stay Informed, Get Involved

Whether you're an Indigenous economic development organization evaluating new opportunities or a resource company seeking data-driven insights to inform decision-making, Indigenous Energy Monitor offers essential tools and analysis to support your success.

🔗 Explore our solutions: www.indigenousenergymonitor.ca

📩 Contact us: info@indigenousenergymonitor.ca

Comments