Measuring Indigenous Procurement in Canada's Oil Sands (2024)

- IEM

- Jan 4

- 5 min read

Indigenous participation in Canada’s energy sector is often discussed through high-level commitments, total spending figures, or individual partnership announcements. While these metrics are important, they can obscure a critical question:

How much Indigenous economic participation is embedded in each barrel of oil produced?

To help answer this, Indigenous Energy Monitor (IEM) analyzed publicly reported 2024 Indigenous vendor and procurement spending by the four major oil sands producers and normalized that spending on a per-barrel-of-oil-equivalent (BOE) basis. The result is a clearer, more comparable view of how Indigenous procurement is integrated into ongoing oil sands operations and gives insight into the procurement and operational strategies of Canada's largest resource firms.

Indigenous Procurement and the Oil Sands

Alberta’s oil sands are one of the largest and most complex industrial systems in Canada, producing over three million barrels of oil per day and representing a core pillar of the national energy economy. Oil sands operations are capital-intensive, long-lived, and deeply embedded in northern Alberta, where many Indigenous communities live, work, and hold rights and interests.

Production in the oil sands is dominated by a small number of major operators. Suncor, Imperial Oil, Cenovus Energy, and Canadian Natural Resources Limited (CNRL) collectively account for the vast majority of total oil sands output, spanning a mix of mining, in-situ, and upgrading assets across the region.

Because of their scale and operating footprint, oil sands producers are also among the largest sources of Indigenous-affiliated procurement in Canada’s energy sector. Ongoing operations require extensive contracting for construction, earthworks, environmental services, logistics, transportation, maintenance, and professional services — many of which are provided by Indigenous-owned or Indigenous-affiliated businesses operating near project sites.

As a result, Indigenous procurement in the oil sands is not limited to episodic capital projects. It is embedded in day-to-day operations, making the sector a critical driver of sustained Indigenous business participation within the broader oil and gas industry.

Understanding how procurement spending relates to production levels is therefore essential. While total Indigenous spend figures are often reported, they do not fully capture how deeply Indigenous businesses are integrated into the ongoing production of oil sands barrels. This makes the oil sands an ideal case study for examining Indigenous procurement intensity on a normalized basis.

Why Normalize Indigenous Procurement Spend?

Most corporate disclosures report Indigenous procurement in absolute dollar terms. While useful, absolute figures are heavily influenced by company size, production scale, and asset footprint.

Normalizing spend on a $/BOE basis helps to:

Improve comparability across producers of different sizes

Distinguish scale effects from procurement intensity

Reveal structural differences in operating models and supplier integration

This approach does not assess intent or quality of engagement. Instead, it provides a consistent analytical lens to understand how procurement is embedded at the operational level.

Indigenous Vendor Spend per BOE — 2024 Results

Using publicly reported 2024 Indigenous vendor and procurement spending and reported upstream production, Indigenous Energy Monitor calculated Indigenous procurement intensity on a per-barrel-of-oil-equivalent (BOE) basis for four major oil sands producers.

Together, these producers represent a substantial share of Canada’s oil sands output and Indigenous-affiliated procurement activity.

Total Indigenous vendor and procurement spend (2024):

Suncor — approximately $3.1 billion

Imperial Oil — approximately $925 million

Cenovus Energy — approximately $845 million

CNRL — approximately $855 million

Combined, these four producers reported approximately $5.7 billion in Indigenous-affiliated procurement spending in 2024.

When normalized against upstream production, Indigenous vendor spend per BOE produced was as follows:

Suncor — $10.27 per BOE

Imperial Oil — $5.85 per BOE

Cenovus Energy — $2.90 per BOE

CNRL— $1.72 per BOE

Across the four producers, average Indigenous vendor spend was approximately $5.2 per BOE, with a wide range around that mean.

This combination of absolute spend and normalized intensity highlights an important dynamic: while all four producers contribute materially to Indigenous procurement in dollar terms, the degree to which Indigenous businesses are embedded in ongoing production varies significantly.

What Drives Differences in Spend per Barrel?

Differences in Indigenous spend per BOE are not solely a function of corporate commitment. They are shaped by a combination of structural, operational, and strategic factors that influence how procurement is generated and embedded within oil sands operations.

One key driver is asset mix and operating model. Not all oil sands barrels are produced in the same way. Producers with large mining operations, on-site upgrading, and high ongoing maintenance and logistics requirements tend to generate higher levels of continuous service contracting. These operating characteristics often create more frequent and sustained opportunities for Indigenous businesses in areas such as construction, earthworks, environmental services, transportation, and operations support. By contrast, producers with a higher proportion of in-situ (SAGD) production and more centralized or standardized operating models may exhibit lower procurement intensity per barrel, even at comparable production volumes.

Capital cycles and project maturity also play an important role. Procurement intensity can vary depending on where assets sit in the development lifecycle. Periods of major expansions, sustaining capital programs, or infrastructure upgrades typically drive higher procurement spend relative to production. Mature assets with lower capital intensity may show reduced spend per BOE despite stable output. As a result, year-to-year comparisons should be interpreted in the context of project timing, capital allocation, and asset maturity.

Finally, differences reflect how Indigenous procurement is embedded within corporate strategy and supplier integration practices. Some producers have long-standing Indigenous procurement programs, formal spend targets or performance metrics, multi-year master service agreements with Indigenous-owned firms, and active supplier development initiatives. Others rely more heavily on Tier-2 or subcontracted participation, project-specific engagement, or less centralized tracking and reporting. These structural differences influence not only total spend levels, but also the consistency, visibility, and predictability of Indigenous business participation over time.

Why This Matters

As Indigenous participation becomes more central to project development, investment decisions, and regulatory processes, how participation is measured matters.

Moving beyond absolute figures toward normalized metrics like spend per BOE:

Improves transparency

Enables more meaningful benchmarking

Supports better-informed conversations among industry, Indigenous organizations, investors, and policymakers

At Indigenous Energy Monitor, our goal is not to rank or score companies, but to provide clear, comparable, and defensible data that supports better decision-making across the energy and resource sectors.

About the Data

This analysis is based on:

Publicly reported Indigenous procurement and vendor spending

Reported 2024 upstream production data

Company annual reports and sustainability disclosures

More analysis like this is available through Indigenous Energy Monitor’s proprietary data tools and research. Follow IEM for upcoming insights on Indigenous procurement, ownership, and participation across Canada’s energy and resource sectors.

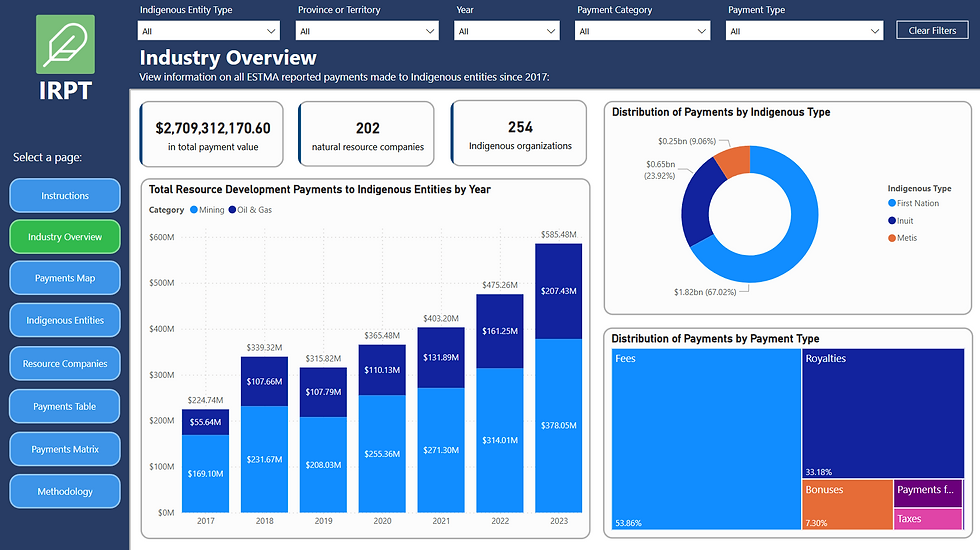

Unlock Transparency for Resource Development

This article outlines the importance of transparency tools like the Indigenous Resource Payment Tracker for Indigenous communities and companies engaged in resource development. By aggregating company-reported payment data pursuant to Canada's Extractive Sector Transparency Measures Act in one place, the IRPT enables users to track the monetary flows from companies to communities.

By centralizing and visualizing payment data, we help communities, companies, and policymakers:

Identify which Indigenous communties are being paid and why

Discover payment flows, types, amounts, and details

Benchmark successful agreement models

Understand trends across regions and sectors

Discover partnerships

And so much more

🔗Discover the IRPT Tool Here: https://www.indigenousenergymonitor.ca/irpt

Stay Informed, Get Involved

Whether you're an Indigenous economic development organization evaluating new opportunities or a resource company seeking data-driven insights to inform decision-making, Indigenous Energy Monitor offers essential tools and analysis to support your success.

🔗 Explore our solutions: www.indigenousenergymonitor.ca

📩 Contact us: info@indigenousenergymonitor.ca

Comments